Category: R

-

How Goals-Based Investing Actually Works: A Case Study (Part 2 of 3)

The code supplement to a case study in goals-based investing published with CityWire.

-

Risk Management for Goals-Based Investors, Some Ideas

Some simple frameworks for risk management in goals-based portfolios.

-

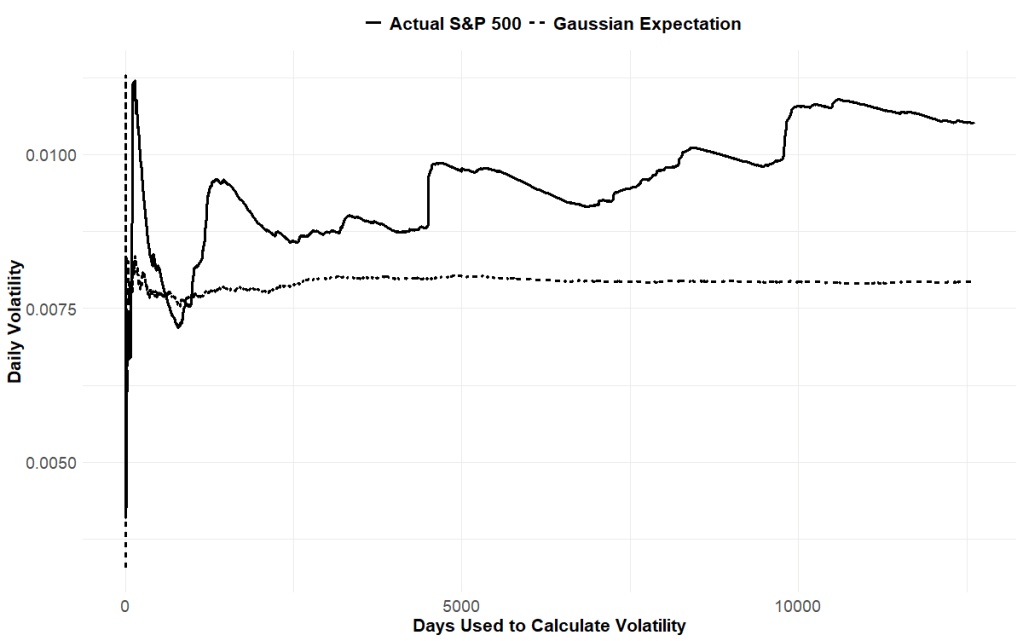

Real Markets

A look at markets as they are, not as we wish them to be. Using R we illustrate two points made in Chapter 5 of Goals-Based Portfolio Theory

· R -

Allocating Wealth Through Time – A Goals-Based Method

Goals-based portfolio optimization across multiple periods.

-

Allocating Wealth Both Across Goals and Across Investments

How to optimize wealth across your goals, as well as to investment portfolios within each of your goals. Supplement to Chapter 3 of my book, Goals-Based Portfolio Theory.

-

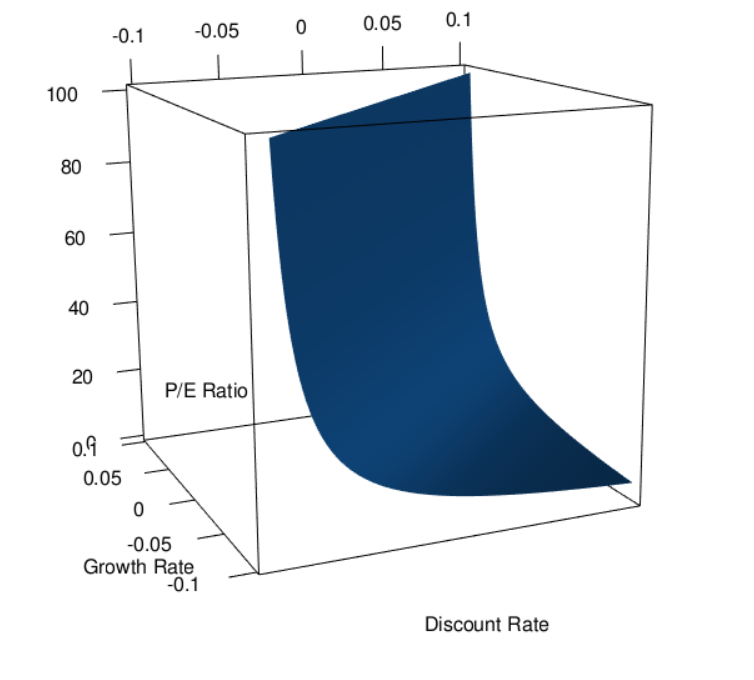

What Does the P/E Ratio Tell You About Investor Expectations?

Price to earnings ratios are readily observable, but what can they tell us about a market or security?

-

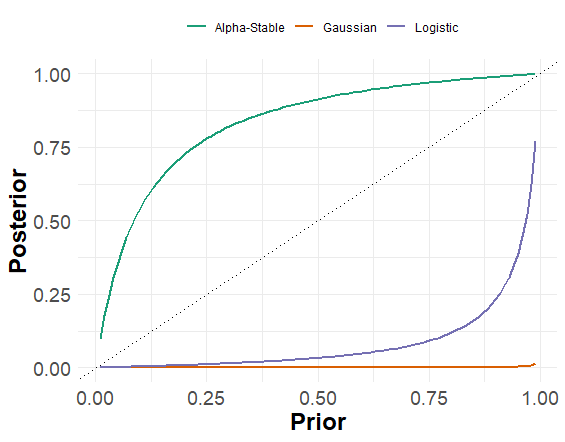

The Return Distribution of Bitcoin

A look at daily and monthly bitcoin return distributions. Which distribution best describes the observed data. And, what does this mean from a portfolio management perspective?

-

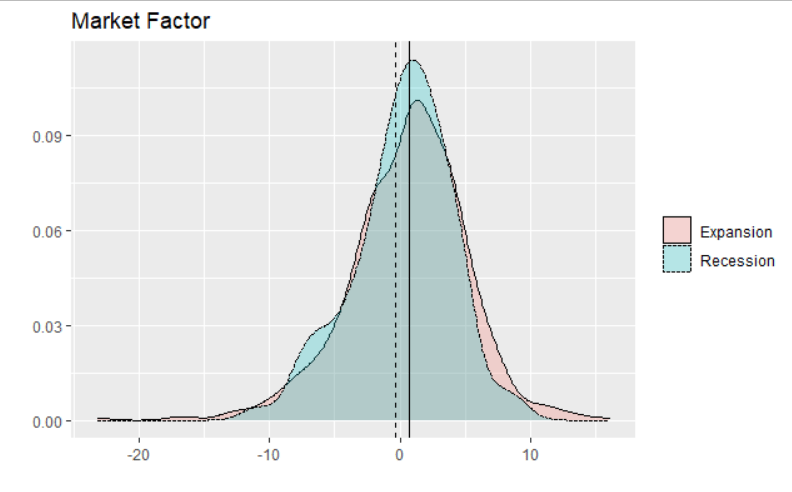

Five Factors Across the Business Cycle

Probably the most popular models in modern investment management are factor models. Growing out of the Capital Asset Pricing Model (CAPM), factor models were first theorized in Arbitrage Portfolio Theory and the concept was expanded and applied to risk premiums by Nobel-laureate Eugene Fama and Kenneth French (French, surprisingly, did NOT win a Nobel prize).…

-

Recession Forecasting with a Neural Net in R

I spend quite a bit of time at work trying to understand where we are in the business cycle. That analysis informs our capital market expectations, and, by extension, our asset allocation and portfolio risk controls. For years now I have used a trusty old linear regression model, held together with bailing wire, duct tape,…

-

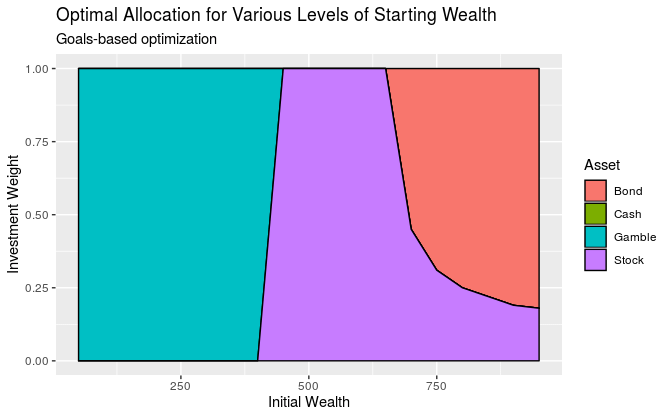

How to Optimize a Goal-Based Portfolio

Traditional portfolio optimization (often called modern portfolio theory, or mean-variance optimization) balances expected portfolio return with expected portfolio variance. You input how opposed you are to portfolio variance (your risk tolerance), then you build a portfolio that gives you the best return given your risk tolerance. Goals-based investing, by contrast, defines “risk” as the probability…