Category: Goals-Based Investing

-

RIA of the Future: Rebuilding Your Firm Around Goals-Based Investing (Part 3 of 3)

Wealth management, as an industry, is slow to change. Perhaps some of that is justified – if clients are happy and continue to pay fees, why invest significant time and money in a whole new approach? But clients are not happy, and we all know the business is changing. Fee compression and the long attrition…

-

Investing for Life: Why I Believe in Goals-Based Investing (Part 1 of 3)

Never once, in my 15-plus years managing wealth, has someone complained about their portfolio rising too quickly. The inverse, of course, is not true: I’ve fielded plenty of complaints about markets dragging portfolios down. Yet both are examples of volatility, and according to traditional portfolio theory, volatility should be minimized – both on the upside…

-

How Goals-Based Investing Actually Works: A Case Study (Part 2 of 3)

The code supplement to a case study in goals-based investing published with CityWire.

-

Investing for life: Why I believe in goals-based investing

Goals-based investing is more than a marketing buzzword, in this first of three articles with CityWire, I detail the differences…

-

Risk Management for Goals-Based Investors, Some Ideas

Some simple frameworks for risk management in goals-based portfolios.

-

Allocating Wealth Through Time – A Goals-Based Method

Goals-based portfolio optimization across multiple periods.

-

Allocating Wealth Both Across Goals and Across Investments

How to optimize wealth across your goals, as well as to investment portfolios within each of your goals. Supplement to Chapter 3 of my book, Goals-Based Portfolio Theory.

-

A Goals-Based View of Security Prices and Market Dynamics: WHAT IF THERE IS NO “CORRECT” MARKET PRICE?

I have been thinking lately about how a market of goals-based investors might interact. As it turns out, the resulting dynamics are rather interesting and not as simple as one might expect. Goals-based utility theory postulates that investors (of all types) interact with capital markets with specific objectives in mind (see Parker 2020). Investors seek…

-

On Horses, Tractors, and Markets

Growing up on a cattle ranch in central Texas, I developed a certain respect for the tools of the trade. Horses, tractors, trucks, trailers, bailing wire, and duct tape we all daily-use items for us. Each tool has its purpose, of course, and each tool has advantages and disadvantages for a particular job. Take, for…

-

How to Optimize a Goal-Based Portfolio

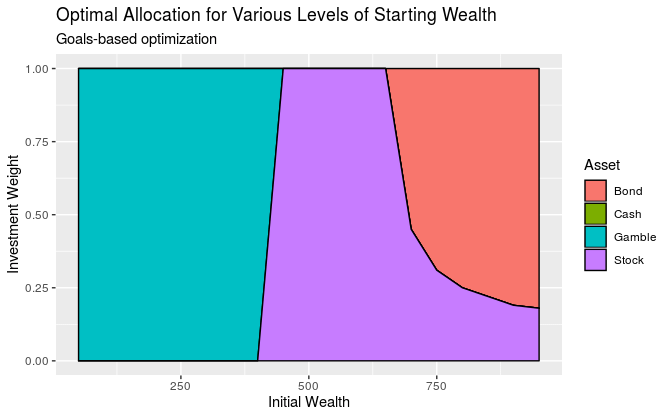

Traditional portfolio optimization (often called modern portfolio theory, or mean-variance optimization) balances expected portfolio return with expected portfolio variance. You input how opposed you are to portfolio variance (your risk tolerance), then you build a portfolio that gives you the best return given your risk tolerance. Goals-based investing, by contrast, defines “risk” as the probability…