Category: Portfolio Optimization

-

How Goals-Based Investing Actually Works: A Case Study (Part 2 of 3)

The code supplement to a case study in goals-based investing published with CityWire.

-

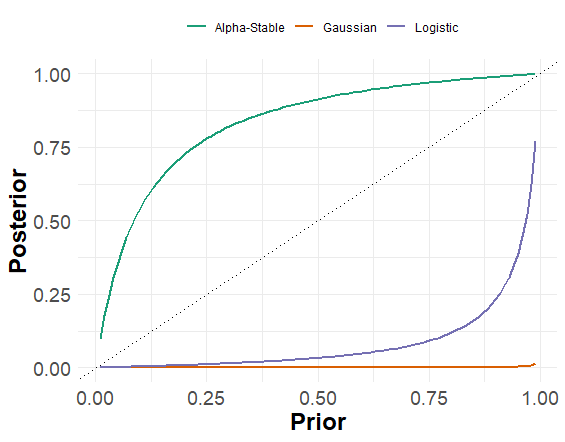

The Return Distribution of Bitcoin

A look at daily and monthly bitcoin return distributions. Which distribution best describes the observed data. And, what does this mean from a portfolio management perspective?

-

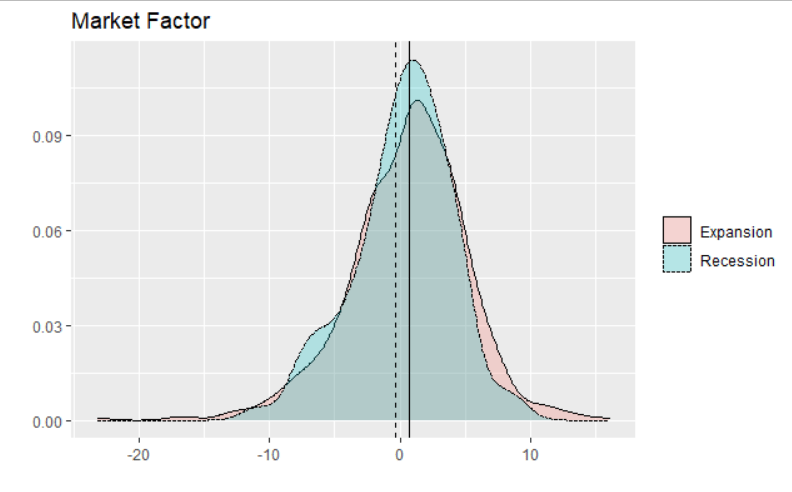

Five Factors Across the Business Cycle

Probably the most popular models in modern investment management are factor models. Growing out of the Capital Asset Pricing Model (CAPM), factor models were first theorized in Arbitrage Portfolio Theory and the concept was expanded and applied to risk premiums by Nobel-laureate Eugene Fama and Kenneth French (French, surprisingly, did NOT win a Nobel prize).…

-

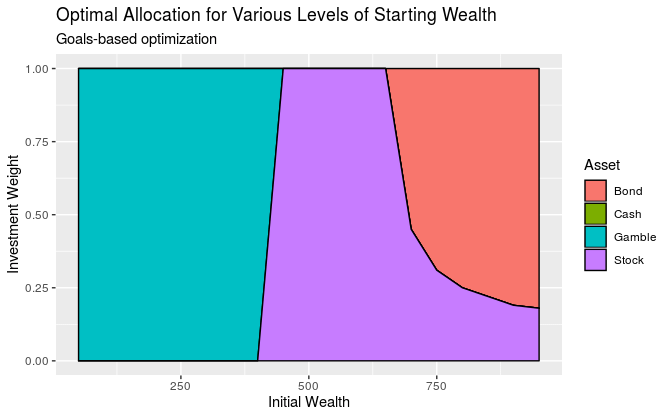

How to Optimize a Goal-Based Portfolio

Traditional portfolio optimization (often called modern portfolio theory, or mean-variance optimization) balances expected portfolio return with expected portfolio variance. You input how opposed you are to portfolio variance (your risk tolerance), then you build a portfolio that gives you the best return given your risk tolerance. Goals-based investing, by contrast, defines “risk” as the probability…

-

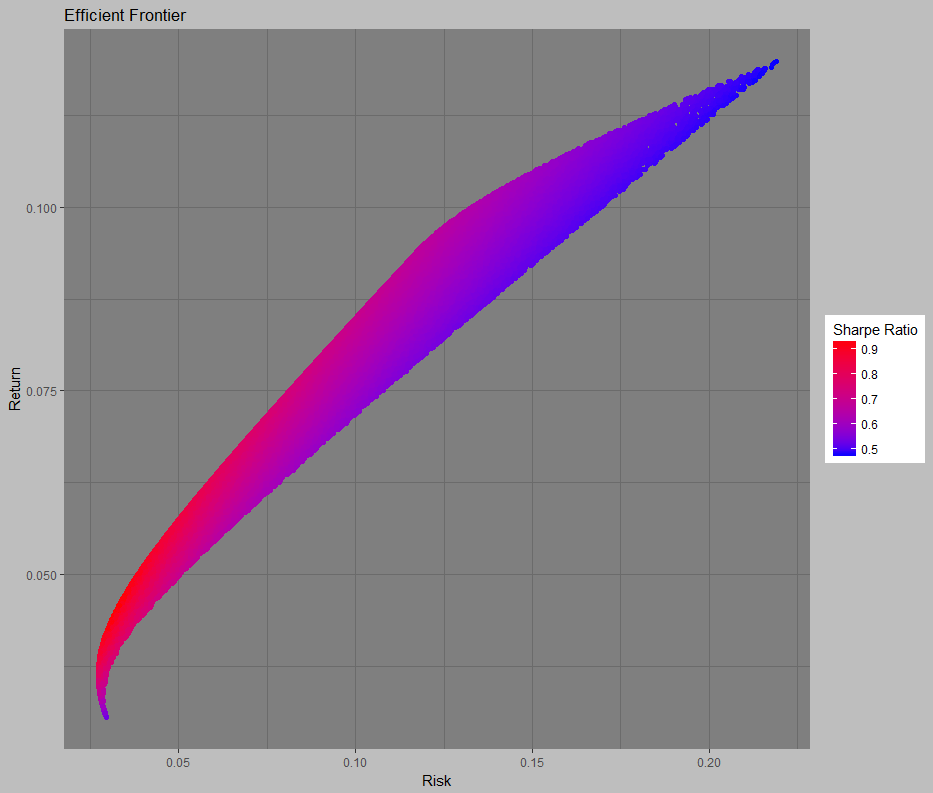

Optimizing a portfolio in R – Monte Carlo method

I regularly use monte carlo engines to answer questions. First, they are really flexible in their ability to model non-normal distributions and assumptions. Second, you can incorporate any constraints you want which may be outside the scope of a non-linear optimization function. At any rate, this is how to use R and a Monte Carlo…

-

How to Calculate the Sortino Ratio in Excel

Used in post-modern portfolio theory (PMPT), the Sortino Ratio punishes only downside risk relative to some required return (usually zero). Unlike the Sharpe ratio, which punishes any type of volatility–up or down. It has some rationality to it–after all, I’ve never had someone call me mad about upside vol. The discrete form of the Sortino…