Category: Original Research

-

How to Not Make Christmas Awkward: a method for cultivating positive dynamics in business families

One of the unique challenges for family businesses is family dynamics, explored by Sasha Lund and Franklin J Parker. They recommend a range of strategies to minimise points of friction, such as educating the next generation, establishing negative space (points of little importance to stakeholders), exploring power dynamics in detail and putting healthy boundaries in…

-

Risk Management for Goals-Based Investors, Some Ideas

Some simple frameworks for risk management in goals-based portfolios.

-

Allocating Wealth Through Time – A Goals-Based Method

Goals-based portfolio optimization across multiple periods.

-

Allocating Wealth Both Across Goals and Across Investments

How to optimize wealth across your goals, as well as to investment portfolios within each of your goals. Supplement to Chapter 3 of my book, Goals-Based Portfolio Theory.

-

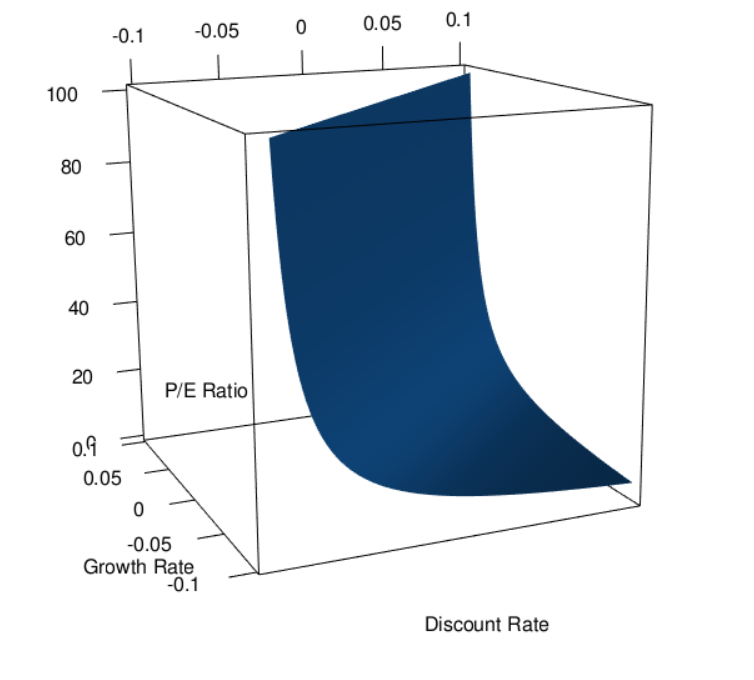

What Does the P/E Ratio Tell You About Investor Expectations?

Price to earnings ratios are readily observable, but what can they tell us about a market or security?

-

Bernoulli’s Prisoner’s Dilemma: A Goals-Based Perspective

In 1738, the Swiss mathematician and physicist Daniel Bernoulli proposed a simple thought experiment: “A rich prisoner who possesses two thousand ducats but needs two thousand ducats more to repurchase his freedom, will place a higher value on a gain of two thousand ducats than does another man with less money than he.” Let’s continue to play this…

-

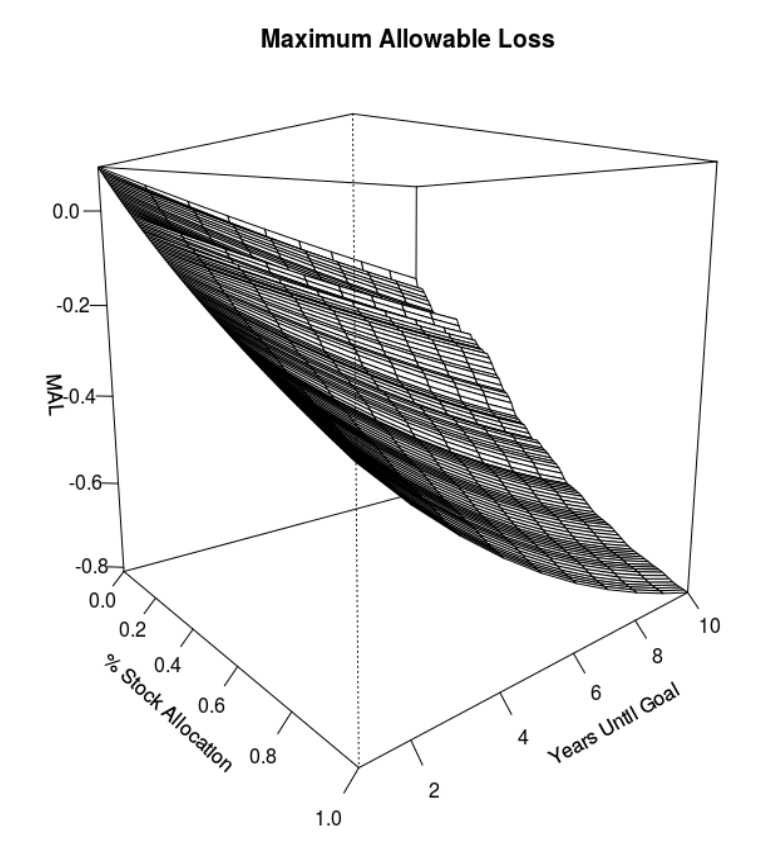

How Much Can You Lose Before You’ve Lost Too Much?

I started my career in finance in 2007. For about a year I thought “this is great!” Then 2008 hit and I thought “this is terrible!” After 2008, I had one fundamental question that I wanted answered: how much can you lose in an investment portfolio before you’ve lost too much? After about five years…