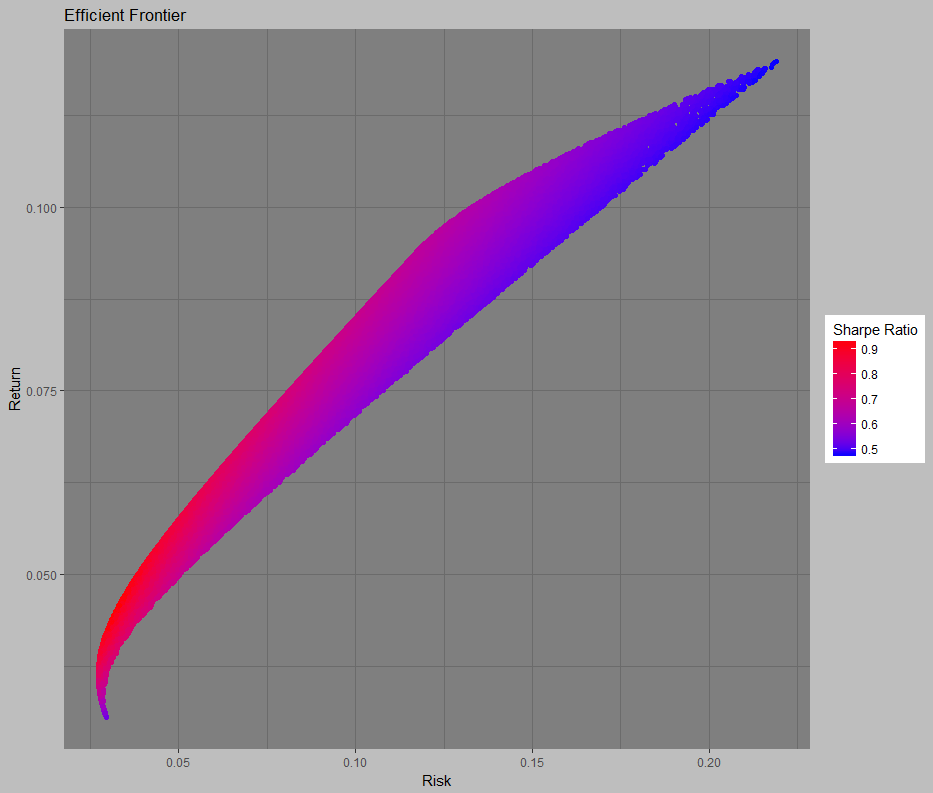

Category: Modern Portfolio Theory

-

Optimizing a portfolio in R – Monte Carlo method

I regularly use monte carlo engines to answer questions. First, they are really flexible in their ability to model non-normal distributions and assumptions. Second, you can incorporate any constraints you want which may be outside the scope of a non-linear optimization function. At any rate, this is how to use R and a Monte Carlo…